TAG

- #いづも巳之助(28)

- #資生堂(186)

- #ANREALAGE(9)

- #ワールド(34)

- #ユニクロ(317)

- #LOUIS VUITTON(118)

- #Vivienne Westwood(15)

- #韓国(65)

- #鴨下ひろみ(14)

- #トレンド(7)

- #訃報(78)

- #GU(102)

- #NIKE(326)

- #ファーストリテイリング(84)

- #FENDI(62)

- #Dior(116)

- #FACETASM(12)

- #adidas(127)

- #髙島屋(43)

- #ビューティ(32)

- #スキンケア(16)

- #JINS(56)

- #ドン・キホーテ(PPIH)(15)

- #United Arrows(89)

- #オオスミタケシ(3)

- #Timberland(35)

- #YVES SAINT LAURENT(23)

- #三陽商会(48)

- #G-SHOCK(67)

- #PEACH JOHN(26)

- #Dolce&Gabbana(19)

- #百貨店(55)

- #マーク&ロナ(46)

- #kate spade new york(13)

- #PUMA(124)

- #Starbucks(19)

- #Calvin Klein(7)

- #メディア(93)

- #読者プレゼント(4)

- #TOSHY(12)

- #ミキモト(10)

- #GUCCI(198)

- #しまむら(11)

- #BTS(22)

- #決算(396)

- #SEIKO(23)

- #COMME des GARÇONS(51)

- #Onitsuka Tiger(51)

- #東急(15)

- #STELLA McCARTNEY(12)

- #THE NORTH FACE (141)

- #GAP(72)

- #WORKMAN(52)

- #中国(69)

- #Moncler(49)

- #出店(43)

- #近藤陽介(3)

- #VOGUE(62)

- #MIZUNO(82)

- #KENZO(22)

- #Beams(84)

- #コラボ(80)

- #リーバイス(35)

- #nanamica(13)

- #ZOZO(186)

- #CELINE(13)

- #Jun Ashida(4)

- #Versace(26)

- #コーセー(99)

- #ASICS(110)

- #New Balance(187)

- #スニーカー(62)

- #barneysnewyork(10)

- #adidas Originals(41)

- #MCM(8)

- #HYKE(12)

- #THE GINZA(2)

- #HUMAN MADE(8)

- #ハースト婦人画報社(19)

- #Tiffany & Co.(58)

- #三宅スタンレー(14)

- #LVMH(125)

- #CHANEL(46)

- #Goldwin(85)

- #adastria(112)

- #Snow Peak(74)

- #GELATO PIQUE(24)

- #XTEP(1)

- #BURBERRY(48)

- #PORTER(10)

- #Saint Laurent(41)

- #香水(1)

- #マッシュホールディングス(18)

- #マッシュスタイルラボ(9)

- #Amuse Beauté(1)

- #THE Marc Jacobs(8)

- #ドン・キホーテ(4)

- #American Apparel(1)

- #mintdesigns(4)

- #LOEWE(40)

- #彩肌通信(12)

- #Supreme(26)

- #BEDWIN&THE HEARTBREAKERS(3)

- #CASIO(78)

- #三越伊勢丹ホールディングス(89)

- #Sale(1)

- #BVLGARI(38)

- #atmos(32)

- #中森明菜(2)

- #marimekko(18)

- #エンポリオ・アルマーニ(11)

- #Condé Nast(28)

- #日本(9)

- #ONWARD(62)

- #Reebok(35)

- #EASTPAK(1)

- #DAZZLE FASHION(3)

- #Hermès(48)

- #Hanae Mori(2)

- #I.T Group(1)

- #Weleda(3)

- #Subscription(3)

- #サンモトヤマ(1)

- #MEXX(1)

- #AHKAH(2)

- #skechers(3)

- #madras(10)

- #Fashion Nova(1)

- #Tom Ford(9)

- #SNIDEL(35)

- #Badgley Mischka(1)

- #Gloverall(1)

- #ルック(19)

- #Richard Ginori(1)

- #SK-II(6)

- #ゲラン(5)

- #Marc Jacobs Beauty(2)

- #FIVEISM × THREE(5)

- #la peau de gem.(2)

- #Alexander McQueen(11)

- #BOBBI BROWN(3)

- #y/m(1)

- #CBD(1)

- #rms beauty(2)

- #neiman marcus(2)

- #jouetie(5)

- #Hudson Yards(1)

- #Maybelline NY(4)

- #Les Merveilleuses LADURÉE(4)

- #THENCE(1)

- #木村拓哉(3)

- #GALERIES LAFAYETTE(1)

- #メディリフト(3)

- #Stuart Weitzman(4)

- #Jeff Koons(2)

- #ONE BY KOSÉ(2)

- #Rick Owens(2)

- #HEELEY(1)

- #MAISON DE REEFUR(8)

- #Acne Studios(7)

- #Globe Trotter(3)

- #ITRIM(12)

- #ReFa(2)

- #Dunkin’ Donuts(1)

- #TEBACO(1)

- #TSUMORI CHISATO(7)

- #Ground Y(6)

- #Amplitude(2)

- #LONSDALE(4)

- #よーじや(1)

- #Isabel Marant(2)

- #Pharrell Williams(2)

- #Walmart(2)

- #ジル スチュアート(15)

- #Juicy Couture(1)

- #オールバー ブラウン(1)

- #nonnative(1)

- #ippudo(1)

- #ALEXANDER WANG(5)

- #shiro(13)

- #Dove(2)

- #NatureLab.TOKYO(2)

- #Carven(3)

- #Clé de Peau Beauté(10)

- #L’Occitane(2)

- #Cartier(33)

- #Jo Loves(2)

- #Cosmopolitan(1)

- #TOMMY HILFIGER(11)

- #YOHO!(2)

- #渋谷ストリーム(1)

- #ホテル(7)

- #mm(2)

- #BPQC(3)

- #Glossier(3)

- #bareMinerals(2)

- #WOOLRICH(7)

- #Moncler Genius(14)

- #DAPHNE(1)

- #日東堂(1)

- #ICICLE(1)

- #リバティロンドン(1)

- #PANTONE(1)

- #Valentino(17)

- #OPENING CEREMONY(2)

- #JUN(22)

- #LANVIN(14)

- #TERRITOIRE(1)

- #ADDICTION(22)

- #Champion(10)

- #CLINIQUE(2)

- #Marchon Eyewear(1)

- #XLARGE®(13)

- #Victoria Beckham(2)

- #Tmall(10)

- #JAM HOME MADE(8)

- #Saranghae(1)

- #NISHIKAWA DOWN(1)

- #スイーツ(1)

- #Dr. Martens(13)

- #3INA(1)

- #X-girl(20)

- #Samantha Thavasa(29)

- #SECOO(1)

- #COS(7)

- #New Look(1)

- #ERDOS(1)

- #Liu Wen(1)

- #MAKE UP FOR EVER(1)

- #Sulwhasoo(1)

- #ORBIS(10)

- #Harrods(1)

- #Miller Harris(2)

- #Arcadia Group(1)

- #CELINUNUNU(1)

- #URBAN REVIVO(2)

- #Dover Street Market(8)

- #Mango(1)

- #HUNTER(2)

- #BAPY®(2)

- #Perfect Diary(1)

- #In Fiore(1)

- #YUULYIE(1)

- #コスメデコルテ(6)

- #maison kitsune(7)

- #Patagonia(7)

- #magazine(18)

- #ErgoBaby(1)

- #出生数(3)

- #PR(2)

- #Jurlique(3)

- #青山商事(13)

- #鷺森アグリ(1)

- #Paris Collection(7)

- #Mac House(3)

- #Emanuel Ungaro(1)

- #tourist(1)

- #髙橋大輔(16)

- #AMBUSH(11)

- #Van Cleef&Arpels(8)

- #Primark(1)

- #ニワカ(1)

- #VIKTOR & ROLF(1)

- #mellisa(1)

- #みちょぱ(1)

- #電通(31)

- #Halal(1)

- #CITIZEN(4)

- #テッドベーカー(1)

- #ニコアンド(26)

- #Salvatore Ferragamo(12)

- #Yahoo!(7)

- #マウンテンハードウェア(1)

- #メックス(1)

- #アキコアオキ(2)

- #デンハム(1)

- #コヴァ(1)

- #Sustainable(16)

- #オルフェトラック(1)

- #蜷川実花(5)

- #サタデーズNYC(1)

- #Alber Elbaz(7)

- #大丸梅田(1)

- #LAURA ASHLEY(1)

- #ゆうこす(1)

- #TALBOTS(1)

- #Oriental Traffic(13)

- #Laforet(5)

- #CARRERA Y CARRERA(1)

- #DESCENTE PAUSE(1)

- #NFT(23)

- #LuLuLun(4)

- #TASAKI(3)

- #mame kurogouchi(30)

- #China Strategy(9)

- #社会情勢(5)

- #anap(12)

- #ルコックスポルティフ(2)

- #Theory(6)

- #騰落率(29)

- #J-WAVE(1)

- #森英恵(4)

- #Eddie Bauer(12)

- #blackpink(8)

- #齋藤牧里(2)

- #北朝鮮(2)

- #クールジャパン機構(10)

- #パルグループHD(14)

- #パテック フィリップ(2)

- #アンナ・サワイ(2)

- #BEAMS RECORDS(1)

- #Gunze(3)

- #Inbound(5)

- #東京コレクション(2)

- #アツギ(3)

- #HELLY HANSEN(6)

- #H2O(12)

- #SWATCH GROUP(7)

- #東レ(7)

- #パーフェクトスーツファクトリー(1)

- #WEGO(9)

- #BURTON(1)

- #ELLE(11)

- #OAO(2)

- #&Bridge(2)

- #ケユカ(1)

- #ニトリ(23)

- #シックスティーパーセント(17)

- #HOKA ONE ONE(9)

- #MIU MIU(9)

- #カネボウ(8)

- #ABC-MART(29)

- #NERGY(2)

- #エンダースキーマ(3)

- #ロレアル パリ(15)

- #セブン&アイ・ホールディングス(28)

- #米村弘光(1)

- #W Magazine(1)

- #フィラ フュージョン(1)

- #イッセイミヤケ(18)

- #モスキーノ(3)

- #Youth Loser(1)

- #DrunkElephant(3)

- #mechakari(2)

- #motherways(1)

- #ラブレス(2)

- #Desigual(2)

- #ブルックスブラザーズ(10)

- #文教堂(2)

- #トランプルーム(1)

- #Everlast(8)

- #B Monster(1)

- #Moda Operandi(1)

- #アニエスベー(4)

- #フイルナチュラント(1)

- #Suning.com(1)

- #UZU(2)

- #アナスイ アクティブ(1)

- #マークスタイラー(2)

- #Tom Ford Beauty(3)

- #DESCENTE(44)

- #アネッサ(3)

- #Ya-man(16)

- #SONIA RYKIEL(4)

- #Fenty(4)

- #LEON(1)

- #WWD(6)

- #唯品会(2)

- #Forever 21(14)

- #SKP(1)

- #サザビーリーグ(21)

- #Prada(49)

- #Jason Wu(1)

- #Elinor(1)

- #IL BISONTE(4)

- #URBAN RESEARCH(16)

- #おにぎり(1)

- #Los Angeles Apparel(1)

- #ELLE MAKEUP(1)

- #jfw(13)

- #エレッセヘリテージ(1)

- #spiber(1)

- #ストレンジャー・シングス(2)

- #ungaro(1)

- #水原希子(1)

- #RENOWN(15)

- #ヨンドシー(10)

- #ラコステ(15)

- #bobby dazzler(1)

- #Andy Warhol(1)

- #細尾(2)

- #時価総額(3)

- #Gaultier(6)

- #ストライプインターナショナル(3)

- #kracie(1)

- #センサイ(1)

- #Peter Lindberg(1)

- #三喜商事(1)

- #Apple(6)

- #トリー バーチ(1)

- #ジエダ(1)

- #舘鼻則孝(1)

- #ジャメヴ(1)

- #八村塁(1)

- #Franck Muller(7)

- #kaws(7)

- #LINE(11)

- #DANSKIN(5)

- #近藤麻理恵(1)

- #oceans(1)

- #ローレン・サイ(1)

- #Elton John(1)

- #冨永愛(1)

- #speedo(4)

- #Chacott(4)

- #Koh Gen Do(2)

- #東京2020(2)

- #東急電鉄(1)

- #坪効率(1)

- #クラブ愛(1)

- #スライ(10)

- #BALMUDA(12)

- #ENFOLD(4)

- #細野晴臣(1)

- #Tapestry(3)

- #Yohji Yamamoto(36)

- #キャロットカンパニー(1)

- #オートクチュール(2)

- #時計(17)

- #PLAYLIST(1)

- #essie(1)

- #THE NORTH FACE Purple Label(8)

- #投資(1)

- #genten(1)

- #airCloset(3)

- #Kelly Ng(1)

- #HUNTING WORLD(4)

- #POLA(25)

- #Daniel Arsham(5)

- #花王(13)

- #YOOX NET-A-PORTER(7)

- #Urban Outfitters(2)

- #決算(8)

- #JC Penny(3)

- #Alibaba Group(8)

- #アイスタイル(13)

- #リシュモン(17)

- #ELIXIR(8)

- #Giorgio Armani Beauty(11)

- #水着(3)

- #IKEA(10)

- #BIRKENSTOCK(13)

- #Rihanna(1)

- #Savage × Fenty(2)

- #ACRO(8)

- #THREE(10)

- #アイウェア(11)

- #H&M(78)

- #Teva(9)

- #丸井(7)

- #フォリ フォリ(2)

- #Generation X(1)

- #uka(15)

- #ネイルケア(5)

- #DIESEL(21)

- #DIESEL BLACK GOLD(1)

- #インテリア(1)

- #ライフスタイル(4)

- #@cosme(41)

- #アンバサダー(11)

- #メルカリ(37)

- #PlacesplusFaces(1)

- #NYX(4)

- #ASOS(1)

- #チームラボ(3)

- #森星(5)

- #アンダーカバー(27)

- #葛饰北斋(1)

- #souetsu(1)

- #RMK(38)

- #メンズウェア(3)

- #M.A.C.(1)

- #graphpaper(2)

- #haircare(4)

- #waterless(1)

- #Qasimi(3)

- #slam jam(1)

- #VR(4)

- #Jagger Snow(1)

- #Benefit Cosmetics(1)

- #Neutrogena(1)

- #提携(1)

- #SSENSE(4)

- #リアル店舗(1)

- #素材(1)

- #モヘア(1)

- #SIXPAD(1)

- #コスメデコルテ(16)

- #ゼログラビティ(1)

- #BIOTHERM(1)

- #Zadig & Voltaire(2)

- #COACH(35)

- #Saks Fifth Avenue(4)

- #AR(3)

- #デジタル戦略(6)

- #HLA(4)

- #雪肌精(6)

- #Nordstrom(2)

- #Christian Louboutin(4)

- #ハリー・スタイルズ(1)

- #lululemon(25)

- #株式市場(60)

- #Norwegian Rain(1)

- #美容と健康(4)

- #SPA(5)

- #LuxuryBrand(13)

- #Eコマース(29)

- #MASH Beauty lab(5)

- #アート(15)

- #改装(1)

- #カルチャー(2)

- #上海(2)

- #上陸(2)

- #リニューアル(11)

- #デザイナー(7)

- #北京(1)

- #ファッションショー(5)

- #横浜(1)

- #化粧品(44)

- #ショッピングモール(11)

- #デニム(1)

- #別注(1)

- #Henry Cotton’s(1)

- #ブランド終了(14)

- #八木通商(8)

- #イタリア(3)

- #そごう・西武(18)

- #倒産(12)

- #新ブランド(5)

- #ルミネ(12)

- #新宿(1)

- #CELFORD(5)

- #繊維(1)

- #リブランド(1)

- #KITANOBLUE(1)

- #DHC(5)

- #SUQQU(34)

- #RHC Ron Herman(8)

- #GINZA SIX(11)

- #J-Beauty(14)

- #TOKYO BASE(20)

- #Karl Lagerfeld(5)

- #CLARINS(4)

- #BALENCIAGA(51)

- #FURLA(4)

- #RICCI EVERYDAY(1)

- #アフォーダブル・ラグジュアリー(1)

- #海外戦略(7)

- #MOUSSY(15)

- #コレクション(19)

- #BAPE(23)

- #ic! berlin(1)

- #東京(3)

- #KOL(8)

- #ストリートファッション(2)

- #CHIVAS VENTURE(1)

- #Longchamp(10)

- #shu uemura(19)

- #CEO(7)

- #SEVENTIE TWO(1)

- #セブツー(1)

- #Christian Dior(24)

- #STYLENANDA(3)

- #L'Oréal(9)

- #Old Navy(3)

- #agnès b.(15)

- #Harper’s BAZAAR(3)

- #Canada Goose(7)

- #京都(14)

- #IPSA(5)

- #ロゴ(2)

- #ワコール(36)

- #出版業界(17)

- #買収(16)

- #M&A(8)

- #GIF(1)

- #スポーツブランド(6)

- #Kawashima Selkon Textiles(1)

- #T-MICHAEL(1)

- #SNS(4)

- #De La Mer(2)

- #STRIPE INTERNATIONAL(22)

- #AKIRA NAKA(2)

- #NARS(25)

- #原宿(2)

- #Trunk Club(2)

- #CB2(1)

- #Kat Von D Beauty(2)

- #Sephora(10)

- #STAMPD(1)

- #Rag & Bone(1)

- #Katie Grand(1)

- #Y’s(1)

- #New Era(10)

- #Kiehl’s(5)

- #CycleBar(1)

- #Givenchy(21)

- #ProD.N.A.(1)

- #AMOREPACIFIC(1)

- #SOFINA iP(1)

- #エミネム(1)

- #Celvoke(4)

- #オーダーメイド(1)

- #Pocketalk(1)

- #OFRA Cosmetics(1)

- #Marks&Spencer(1)

- #HULIC(1)

- #LANCOME(14)

- #FRED PERRY(5)

- #CA4LA(2)

- #WEF(1)

- #Paris Hilton(2)

- #TOMWOOD(2)

- #ANNA SUI COSMETICS(4)

- #YAKPAK(1)

- #渡辺直美(1)

- #Dolce&Gabbana Beauty(6)

- #MEDICOM TOY(2)

- #TOYOTA(3)

- #EYEVAN(4)

- #LUMIÉRE DU 3COT(1)

- #ZOZOUSED(2)

- #Sears(3)

- #K-Beauty(3)

- #LI-NING(4)

- #AWAYTOMARS(1)

- #Lil Pump(1)

- #Panasonic(1)

- #Jo Malone London(2)

- #Noodle.(1)

- #Jamie エーエヌケー(1)

- #JNBY(1)

- #Thom Browne(7)

- #Ermengildo Zegna(4)

- #Farfetch(13)

- #jane iredale(1)

- #LUISAVIAROMA(1)

- #FACTOTUM(1)

- #Balmain(5)

- #UGG(22)

- #ラルフローレン(21)

- #フローフシ(3)

- #Y’s BANG ON!(1)

- #ViVi(3)

- #Baby-G(12)

- #限定(4)

- #The Weeknd(1)

- #JIMMY CHOO(18)

- #ケリング(89)

- #Tik Tok(4)

- #マーク・ゴンザレス(1)

- #JanSport(1)

- #FIND KAPOOR(2)

- #Too Faced(5)

- #Under Armour(17)

- #Dolls Kill(1)

- #Flora Notis JILL STUART(4)

- #ETUDE HOUSE(2)

- #Repetto(4)

- #Michael Kors(14)

- #October’s Very Own(1)

- #REVLON(1)

- #KIJIMA TAKAYUKI(3)

- #人工知能(3)

- #J.M. Weston(2)

- #ワールドカップ(13)

- #JOTARO SAITO(1)

- #White Mountaineering(8)

- #トモコイズミ(4)

- #GROBAL WORK(1)

- #ropepicnic(4)

- #unenanacool(1)

- #grounds(1)

- #SOMARTA(1)

- #Boka nii(1)

- #ソシャモ(1)

- #CAMPER(2)

- #MAMMUT(6)

- #UUUNI(1)

- #藤原ヒロシ(19)

- #在庫・廃棄問題(2)

- #西松屋(5)

- #TENTIAL(7)

- #Herschel Supply(1)

- #Designer Parfums(1)

- #tomorrowland(7)

- #UNDERSON UNDERSON(2)

- #TSIホールディングス(43)

- #リエンダ・スエルタ(1)

- #pierre hardy(2)

- #ACUOD by CHANU(1)

- #KIMONO(4)

- #Honest Beauty(1)

- #皆川明(6)

- #羽生結弦(3)

- #マッドフルーツ(1)

- #シーニューヨーク(1)

- #VANS(10)

- #PARCO(20)

- #グリーンコットン(1)

- #L'Offincine Universelle Buly(1)

- #ケースティファイ(3)

- #edwin(4)

- #OAKLEY(14)

- #TOGA(8)

- #herlipto(1)

- #nanoUNIVERSE(7)

- #Playboy Fragrances(1)

- #BOTTEGA VENETA(22)

- #lucien pellat-finet(3)

- #RIZAP(8)

- #Visee(5)

- #上場(4)

- #撤退(1)

- #Honeys(8)

- #Abercrombie&Fitch(5)

- #COVERGIRL(1)

- #AIスピーカー(1)

- #Ray-Ban(1)

- #Lime Crime(1)

- #Awake(4)

- #FILA(7)

- #MTG(18)

- #Off-White(17)

- #ヴァージル・アブロー(15)

- #RIMOWA(12)

- #Amazon(18)

- #無印良品(71)

- #SONY(1)

- #Bergdorf Goodman(3)

- #安室奈美恵(3)

- #Dries Van Noten(9)

- #RAGTAG(3)

- #富士フィルム(4)

- #2次流通(4)

- #DISNEY(14)

- #ポップアップ(22)

- #香水(6)

- #Instagram(5)

- #Missoni(3)

- #Vendome Aoyama(1)

- #Zoff(32)

- #ZARA(42)

- #ito design studio(1)

- #ジュエリー(8)

- #DIOR FINE JEWELRY(2)

- #CHAUMET(3)

- #OPERA(2)

- #FUMITO GANRYU(4)

- #Macy's(3)

- #YouTuber(13)

- #sacai(42)

- #ボクシング(7)

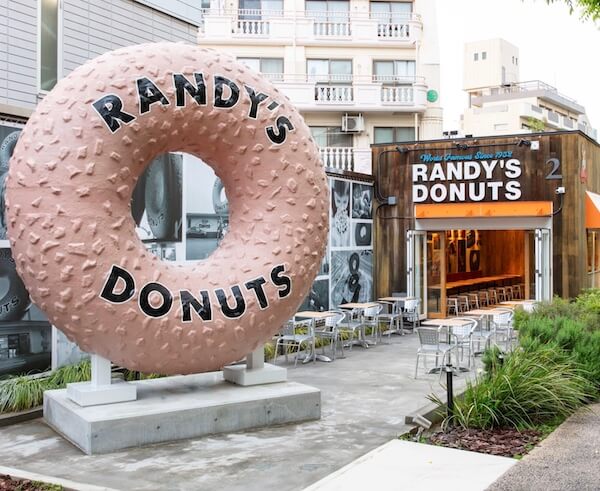

「ドン・キホーテ」は、とにかく株を買うタイミングが取りづらい。まず、3年間ずっと右肩上がりで経営成績がすこぶる良く、もはや株価も過熱気味なところだ。また、あのユニークすぎる(笑)PBと店頭展開が、フツーの流通関係者から見ると理解し難い部分??も当然ある。しかし、インバウンドの顧客心理の掴み方は本当に素晴らしく、確実に売れ線を作るノウハウがある。年間1千億円超の免税売上は、その証拠だ。今回、新しくできるインバウンド店舗は、棚からぼた餅のような素晴らしい新宿の物件だし、何をするのか楽しみだ。ドンキが更にブレイクするかもしれない。